Blog

7 Important Ages for Retirement Planning

Blog“7 Important Ages for Retirement Planning" The amount of decisions and timeframes that arrive at your doorstep as you head into retirement can be overwhelming. It’s hard to keep track of what age you become eligible for Medicare vs. when you can take social...

5 Keys to Investing in 2026

Blog“5 Keys to Investing in 2026" I enjoyed reading this recently published piece from American Funds. Yes, there are concerns as we enter into 2026, but is there ever a perfect time to invest?? What a difference a few years can make. At the start of 2023,...

Merry Christmas and Happy New Tax Year

Blog“Merry Christmas and Happy New Tax Year" We want to wish you a very Merry Christmas and hope that you all find time to celebrate with family and loved ones this holiday season. As we end one year, another starts and with a new year comes quite a number of new tax...

The Pursuit of Independence as Your Financial Goal

Blog“The Pursuit of Independence as Your Financial Goal" As your financial advisor, I believe a truly great life boils down to a simple, two-part formula: Independence plus Purpose. Purpose is personal—it might be family, community, your faith, or your work. But...

“A Note on Markets, Perspective, and Gratitude”

Blog“A Note on Markets, Perspective, and Gratitude" As we approach Thanksgiving, a time for family, reflection, and gratitude, it’s also a time when many of us naturally take stock of our financial lives. The financial news headlines have been hard to ignore lately,...

Are we in an AI Bubble

Blog“Are we in an AI Bubble" The question of whether or not we are in an AI bubble is something that has been on many people’s minds over the past 6 months. Tech stocks seem to be carrying the market as evidenced by the fact that the top 7 companies in the S&P 500...

The All-Time High Dilemma: Why 2025’s Records Are Just Another Step

Blog“The All-Time High Dilemma: Why 2025's Records Are Just Another Step" The 2025 Market Story So Far As we head into the final quarter of 2025, it’s hard to ignore the headline: the stock market is setting records again. The S&P 500 index recently surpassed the...

Inflation: The Silent Killer of Retirement Plans

Blog“Inflation: The Silent Killer of Retirement Plans" We talk a lot about inflation in the headlines – rising gas prices, higher grocery bills, the cost of... well, everything. But while we feel its immediate pinch in our daily lives, there's a far more insidious and...

The 4% Rule is now the 5% Rule

Blog“The 4% Rule is now the 5% Rule" A financial expert named Bill Bengen, who created the famous 4% Rule, has a new book called A Richer Retirement: Supercharging the 4% Rule to Spend More and Enjoy More. The 4% Rule was a game-changer for retirement planning because...

The Life Satisfaction Smile

Blog"The Life Satisfaction Smile" I heard the concept on a podcast recently that was talking about what makes people truly happy. It’s an age old question and one that I would guess we aren’t going to have a universal answer for or “solve” anytime soon. That being...

Proof of Wealth

Blog"Proof of Wealth" I often enjoy reading other thoughts and posts from financial experts in the field, and a recent post by Nick Maggiulli really hit home. It’s great if someone has a financial windfall or even wins the lottery but there is also something to be...

How AI is Reshaping the World of Finance

Blog“How AI is Reshaping the World of Finance" The financial landscape is undergoing a seismic shift, and at the epicenter of this transformation lies artificial intelligence (AI). From the mundane tasks of customer service to the complex calculations...

Repayment Assistance Plan; what you need to know

Blog “Repayment Assistance Plan; what you need to know" The student loan journey is often a long and winding road, and for millions of Americans, it's a road filled with financial uncertainty. The weight of monthly payments can feel crushing, especially when your...

Navigating Your Financial Landscape: Key Updates from the “Big Beautiful Bill “

Blog“Navigating Your Financial Landscape: Key Updates from the "Big Beautiful Bill" The recently passed "Big Beautiful Bill" (BBBP), signed into law on July 4, 2025, includes several provisions that are relevant for a wide range of individuals and families. This...

Mirror Image Quarters and Iran

Blog“Mirror Image Quarters and Iran” Maybe it goes without saying, but 2025 has not been short of news headlines and we are just coming up to the halfway point in the year! Interestingly the entire 2020’s decade so far has been quite a volatile one. Up to this point...

You Can’t Put a Price On Mental Freedom

Blog“You Can’t Put a Price On Mental Freedom" We typically don’t recommend individual stock holdings for customers. While we will keep some holdings if the client is adamant about a specific company, we believe in a more passive and diversified equity strategy. This...

The Boring Advice Proves Itself Again

Blog“The Boring Advice Proves Itself Again" 2025 has certainly been a roller coaster ride for stocks. Just over a month ago the S&P 500 was down over 15% for the year, and now, as I write this on May 13th, the S&P 500 has gained 18.3% since April 8th. It’s...

The Housing Issue for Younger Americans

Blog“The Housing Issue for Younger Americans" For many of our clients, housing and the growth of their primary residence (and potentially investment properties) was a large contributor to their overall financial success. Yes, we all know that interest rates were much...

Navigating Tariffs: Why History Favors the Patient Investor

Blog“Navigating Tariffs: Why History Favors the Patient Investor" Staying the Course Amidst Tariff Turbulence It’s hard to ignore the recent headlines. Talk of tariffs, potential trade disputes, and the resulting market swings can naturally cause unease for even the...

A Recession Won’t Help the Budget

Blog“A Recession Won’t Help the Budget" Every so often I come across a theory that makes sense superficially but on closer examination doesn’t add up. The most recent one is that the current Administration wants a recession (or at least wouldn’t mind one) because...

Your Goals > Stock Market Movements

Blog“Your Goals > Stock Market Movements" Investors are nervous right now. For those who’ve been reading our weekly articles for some time, you might recognize the above title. We have re-visited the idea that your personal goals should hold a greater weight in...

Humility Comes with Experience

Blog“Humility Comes with Experience" The more time I spend in finance, the more I realize how little we truly know or how foolish it is to try and predict what is going to take place. I’m convinced that if someone is absolutely certain of their belief of what will...

8 Important Ages for Retirement Planning

Blog“8 Important Ages for Retirement Planning" The amount of decisions and timeframes that arrive at your doorstep as you head into retirement can be overwhelming. It’s hard to keep track of what age you become eligible for Medicare vs. when you can take social...

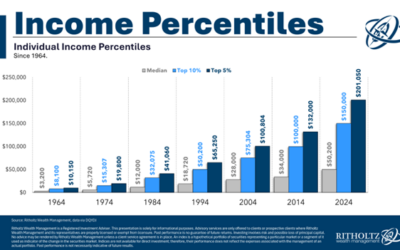

What’s Considered a High Income These Days?

Blog“What's Considered a High Income These Days?" The comparison trap is dangerous. Whether we are looking at our neighbor's car, or the houses in “that fancy party of town”, comparing our situation to others can have negative effects. So, my goal for this article...

Van Gelder Financial

Curious to know more?

We offer a free 30 minute introductory call for those interested in becoming clients with Van Gelder Financial. During this call we will ask a lot of questions and answer any that you may have to ensure there is a match.