Blog

“How Americans Save, Spend and Invest”

Ever since the pandemic hit us in early 2020, something that has been very interesting to watch is how Americans save, spend, and invest their money. While during COVID lockdowns, our spending choices looked different, the reality is that American consumption and spending both during and after COVID has never been healthier. What have these higher consumption rates meant for saving and investing for the future? This recent article by Ben Carlson from A Wealth of Common Sense, does a good job diving into the figures and how they have been changing over the past few years.

There are three things you can generally do with your money: you can spend it, you can save it or you can invest it.

As Americans, we LOVE to spend it. It’s likely one of our greatest collective talents and it’s a big reason the consumer makes up something like 70% of the economy. The crazy thing is, the pandemic made us all want to spend even more money.

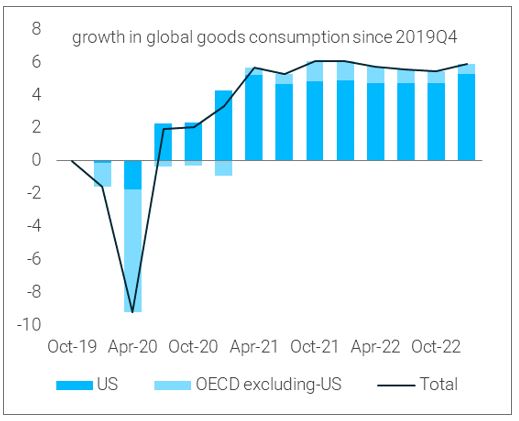

Dario Perkins shared two charts this week that bear this out. The growth in consumption habits around the globe since the start of the pandemic has basically all come from the United States compared to other developed nations:

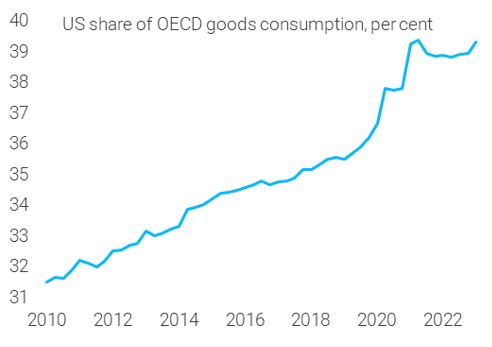

And just look at that jump in the share of goods consumption that started in 2020:

This trend was already in motion but we’ve taken our spending to another level over these past 3 years or so. There are a number of reasons for this increase in spending.

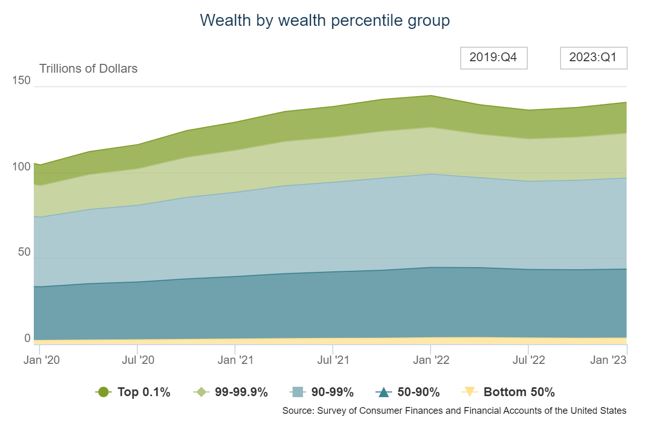

People couldn’t travel or go out and spend on experiences for a while there so we all started buying more stuff. But people also got wealthier during the pandemic:

Total household wealth has gone from $104 trillion in the first quarter of 2020 to $140 trillion by the first quarter of 2023. Housing prices are up, stock prices are up, incomes are up and prices are up so it makes sense that spending is up.1

One of the reasons wealth has skyrocketed higher is because the demographic with the most money owns most of the stocks.

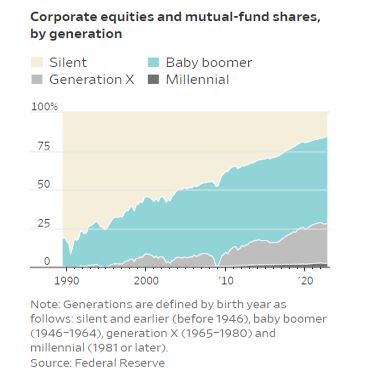

Baby boomers hold around 54% of the wealth in the United States. According to The Wall Street Journal, they also own nearly two-thirds of the stocks:

It makes sense that the boomers hold so many stocks. There are 70 million of them and they’ve had many decades to stockpile equities.

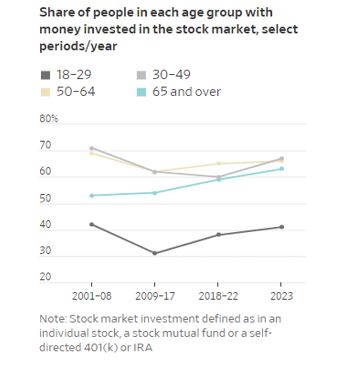

This chart, however, may come as a surprise:

The 65 and older crowd has actually been increasing their allocation to stocks this century.

One would think as you approach retirement age that your portfolio would become more conservative but older investors have been adding to their stock exposure.

This doesn’t make sense from the perspective of the Jack Bogle 100 minus your age rule. But it does when you consider how low interest rates have been for most of this century.

Plus, older investors have far more experience dealing with bear markets. They know the long-term returns for stocks are good as long as you hold on.

When it comes to retirement accounts, most investors have an even higher allocation to stocks.

One of my favorite annual updates is the Vanguard How America Saves report on the state of their defined contribution plans.

The average allocation to stocks in Vanguard retirement plans is 77%.

I’m stating the obvious here but it bears repeating — if you want to invest your money you first have to get your spending under control so you have the ability to save.

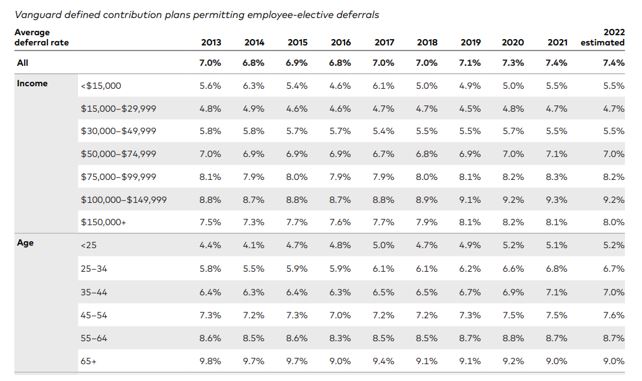

Vanguard suggests a savings rate of 12-15% to reach your retirement goals. I’ve always said the goal for most people should be a double-digit savings rate as a percentage of their gross income so we’re on the same page here.

The average savings rate among Vanguard-sponsored retirement plans in 2022 was 7.4%. You can see how things shake out across income levels and age groups as well:

Not quite there yet in terms of Vanguard’s goal but they said 20% of participants would need to boost their savings rate by just 1% to 3% to hit the 12% to 15% target. Plus, if you include the employer match, the average contribution rate jumps to 11.3%.

The biggest benefit of all the spending we do in our economy is that one person’s spending is another person’s income.

If you live below your means with that income you can save some money. And if you take those savings and invest the in the financial markets you can grow your wealth.

Household finances in this country are far from perfect but collectively we’re in a pretty decent place when it comes to spending, saving and investing. This is one of the biggest reasons the economy has remained so resilient in the face of incessant rate hikes and recession predictions.