Blog

“Reasons to be Optimistic about 2021″

I think everyone is ready to be done with 2020. Have there been silver linings and things to be grateful for in 2020? Yes! However, for many families, 2020 was filled with economic hardship, time without close family members, and perhaps even grief of lost loved ones. We certainly don’t want to make light of what some have had to go through in 2020, but we also want to do our best to look forward. What does 2021 have in store for us? Is it reasonable to believe that things will really start to look different as we get into the second half of 2021? In this article, we explore various reasons to be optimistic about the economic and financial outlook of 2021.

Opportunities for Innovation Abound

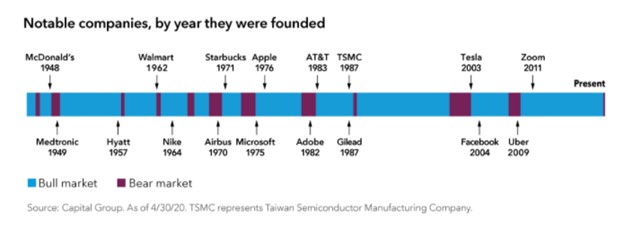

2020 has shown us the speed and depth of the tech and medical sectors. The ability to process and effectively utilize mass amounts of data seems to be improving at warp speed with companies like Snowflake and Palantir reaping the rewards. Besides big data trends, what other new technologies are set to benefit and grow coming out of the COVID 19 pandemic? The idea that innovation can be berthed out of difficult economic times is certainly not a new one. You only have to look back over the last 50 years to see some notable names that have emerged from difficult economic times:

- Airbus (’70), Microsoft (’75), Apple (’76)

- Tesla (’03), Facebook (’04)

- Uber (’09), Zoom (’11)

Travel Could Open Up

The promise of a COVID vaccine (or multiple vaccines) seems to be gaining traction every day. In addition to this, there is reason to believe that travel could actually be safer in 2021 than most other times in recent history. Improved testing procedures, airlines improving their sanitation measures, and hotels and resorts being more conscious than ever are all reasons to feel safe about some sort of travel in 2021. Will the travel look a little different than we are used to? Perhaps. Personally, I’ll take travel that looks slightly different vs. staying at home for another year!

Consensus is Building for Market Growth

If investors currently have cash that is not invested in the market, let’s explore some prominent options they have for investing. Below, we have shown current rates of return for various asset classes:

- Cash -2.3% due to inflation (Kiplinger)

- 1 Year CD 0.6% (Bankrate)

- 1 Year Corporate Bond Rates 0.28% (St. Louis Fed)

- S&P 500 Estimates for 2021 11.6% (Goldman Sachs, Barclays, Morgan Stanley)

Based on these options alone, you can see why some investors may be willing to take the risk of short term stock market volatility for a portion of expected stock market gains. Analysts across the board see many positive signs in 2021 that are closely tied to the mass production of a COVID vaccine. With global economies hopefully opening up, and individuals with “pent up” demand, it could produce a compelling combination for GDP growth. Are there other asset classes such as real estate and commodities that we haven’t explored? Yes, but the point we are making is that with interest rates at record lows for the foreseeable future, stocks could be the best alternative for a place to park your cash.

Everyone’s situation is unique and should be considered. For some, 2020 may seem like a blip on the radar. For others, this year has completely shaken their economic and financial foundation. No matter which camp your in, I believe there are reasons to be optimistic about 2021 and our longer-term future.