Blog

“Investing Lessons from 2020“

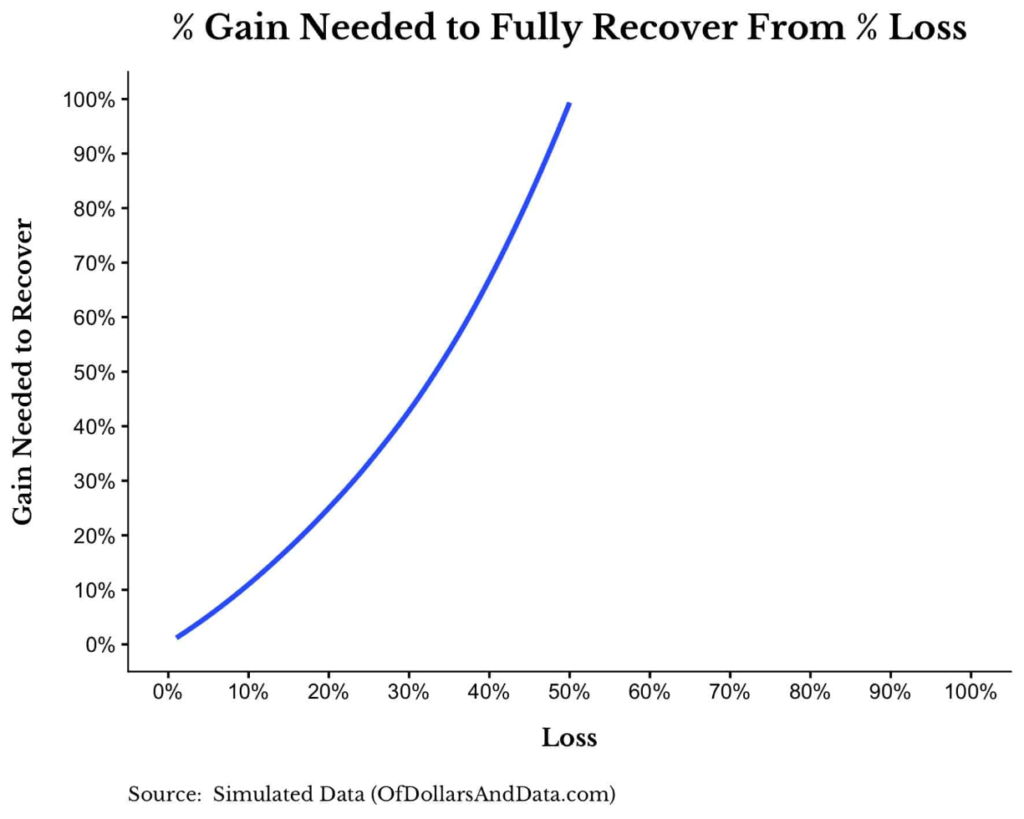

Most of us want to leave 2020 behind (myself included), as it was a year filled with difficulty and heartache for many. However, the year was filled with investing lessons that I think are worth noting for years to come. I recently read an article by Nick Maggiulli of Ritholtz Wealth that talked about some of the key lessons that he is taking away from 2020. In this article, I share a few of his findings. The Bigger the Decline, The Bigger the Potential Recovery If equity markets demonstrated anything this year it was that large price declines have the potential for even larger recoveries. Why? It’s simple math. If a 20% drop in prices requires a 25% recovery to get back to even, then a 33% drop in prices requires a 50% recovery to get back to even, and so forth: And since 2020 witnessed a 33% decline in the S&P 500 (from peak to trough), this means that the unexpectedly quick recovery was even better for those that got in near the bottom in late March. While no one could have predicted that such a recovery would follow, the fact that a recovery did follow meant huge gains for those who stayed the course.

Price is what Someone Else is Willing to Pay for something

2020 saw Bitcoin re-reach $20,000 a coin (it’s now over $45,000 for one coin!), Tesla exceed $600 Billion in market capitalization, and oil drop below $0 a barrel. While none of these prices may make sense to some investors, they made sense to the person who bought them.

As long as markets exist, assets will always be priced based on what someone else is willing to pay for them. This has never been more evident than the recent rise in valuations among non-profitable tech companies. But as long as enough buyers are willing to pay such elevated prices, they will continue.

While such an occurrence may seem like an easy short opportunity, it is anything but. As the famous phrase goes:

“The market can remain irrational longer than you can remain solvent.”

Try to keep this in mind when investors look like they are losing theirs.

Markets often Rhyme but rarely Repeat

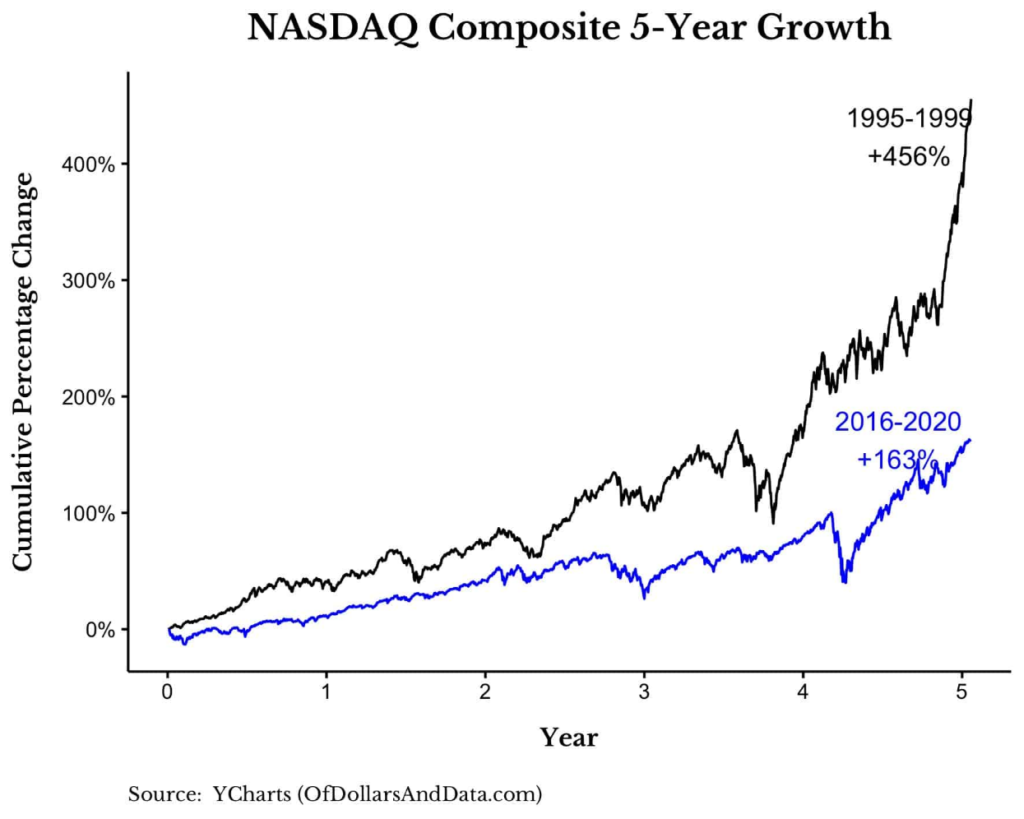

With the many eye-popping valuations of various technology IPOs in 2020, it can feel a bit reminiscent of 1999. And while stock prices might be high, 2020 is no 1999. Just take a look at the growth in the NASDAQ from 1995-1999 compared to 2016-2020 and you will see that it’s night and day:

And since 2020 witnessed a 33% decline in the S&P 500 (from peak to trough), this means that the unexpectedly quick recovery was even better for those that got in near the bottom in late March. While no one could have predicted that such a recovery would follow, the fact that a recovery did follow meant huge gains for those who stayed the course.

Price is what Someone Else is Willing to Pay for something

2020 saw Bitcoin re-reach $20,000 a coin (it’s now over $45,000 for one coin!), Tesla exceed $600 Billion in market capitalization, and oil drop below $0 a barrel. While none of these prices may make sense to some investors, they made sense to the person who bought them.

As long as markets exist, assets will always be priced based on what someone else is willing to pay for them. This has never been more evident than the recent rise in valuations among non-profitable tech companies. But as long as enough buyers are willing to pay such elevated prices, they will continue.

While such an occurrence may seem like an easy short opportunity, it is anything but. As the famous phrase goes:

“The market can remain irrational longer than you can remain solvent.”

Try to keep this in mind when investors look like they are losing theirs.

Markets often Rhyme but rarely Repeat

With the many eye-popping valuations of various technology IPOs in 2020, it can feel a bit reminiscent of 1999. And while stock prices might be high, 2020 is no 1999. Just take a look at the growth in the NASDAQ from 1995-1999 compared to 2016-2020 and you will see that it’s night and day:

I don’t think the stock market is in a bubble, but it’s surrounded by them. This chart illustrates that there is a big difference between “bubble” and “BUBBLE.” As my colleague Michael Batnick recently argued:

I don’t think the stock market is in a bubble, but it’s surrounded by them. This chart illustrates that there is a big difference between “bubble” and “BUBBLE.” As my colleague Michael Batnick recently argued:

I don’t think the stock market is in a bubble, but it’s surrounded by them.

Though we aren’t in 1999, some investors definitely are. Markets often rhyme but rarely repeat. In summary, 2020 did a lot to award strategies that we have been preaching for years. Developing a long-term investment strategy that accounts for risk and takes a diversified approach tends to bode well. Certainly, past results are not predictive of the future, but staying the course benefited many investors in 2020.Copyright © 2024

Van Gelder Financial