Blog

“Your New 2023 Tax Rates & More“

The Internal Revenue Service recently announced their annual inflation adjustments for the tax year 2023. Higher recent inflation means that some of these numbers are up by a greater degree compared to previous years. Here are the major adjustments and changes as we get ready for 2023:

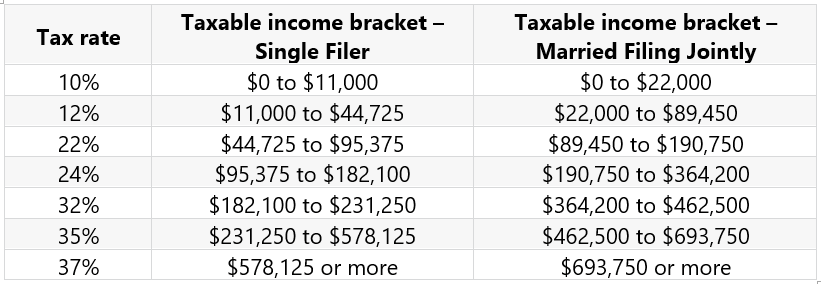

2023 Federal Income Tax Brackets

Other Notable Items (Subject to change based on Legislation Changes)

- Standard Deduction would go to $13,850 for Single, and $27,700 for Married Filing Joint

- Capital Gains rates are remaining at either 0%, 15%, or 20% depending on taxable income levels

- Federal Estate Tax Exemption moves to $12.92M per person or $25.84M for a married couple

- Annual Gift Tax exclusion changes to $17,000 (was previously $16,000)

Retirement Account Proposed Changes

- Salary Deferral Limit for workplace retirement plans goes from $20,500 to $22,500

- Overall retirement plan contribution limit (including employer contributions) is now $66,000 or $73,500 if over age 50

- SIMPLE IRA contribution limits jump to $15,500 per year or $19,000 if over age 50

- Traditional IRA and Roth IRA contribution limits move to $6,500 or $7,500 if over age 50

As stated, this information is subject to change depending on the final bills to come out of Washington before year-end. Regardless the key takeaway is that due to some high inflation, we currently have some meaningful expected changes that will be made to both taxable income brackets and retirement savings thresholds.