Blog

“Yield Curve Inversion”

If you loan (not gift) someone money for 2 years, you would expect to get your money back plus some level of interest since they held your money for 2 years. If you decided to loan that same money to someone for 10 years you would likely expect to get all your money back after 10 years plus a higher amount of interest compared to the 2-year option. It makes logical sense that the longer you allow someone else to borrow your money, the higher interest rate you would require.

However, what isn’t following this logic right now is the interest rates on government debt. Right now, someone would earn around 4.9% for loaning their money to the government for 2 years, but would only earn 4.04% if they loaned out their money for 10 years.

Yes, that’s right! You are NOT getting compensated for picking longer-term debt right now. But why??

Yields on short-term bonds are pegged to the interest rate set by the Federal Reserve. Over the past year and change, in an effort to combat rampant inflation, the Federal Reserve embarked on a series of hikes to its benchmark interest rate, which has risen from near zero to a range of 5.25% to 5.5%.

In the meantime, a chunk of investors have grown skittish about the economy, worrying that the Fed’s aggressive rate hike regime could slow the economy to the point that it tips into recession.

In those scenarios, “traditionally, government bonds have been a safe haven,” says Sam Stovall, chief investment strategist at CFRA. “The U.S. government doesn’t go out of business, but shaky companies do. Even pretty stable companies experience challenging times during recessions.”

So, with these investors scared of the future, they flock to long-term government bonds, and drive up the price of those investments. Since bond prices and interest rates move in opposite directions, long-term Treasurys have seen a decline in yield (i.e. the 10 year is paying less than the 2 year).

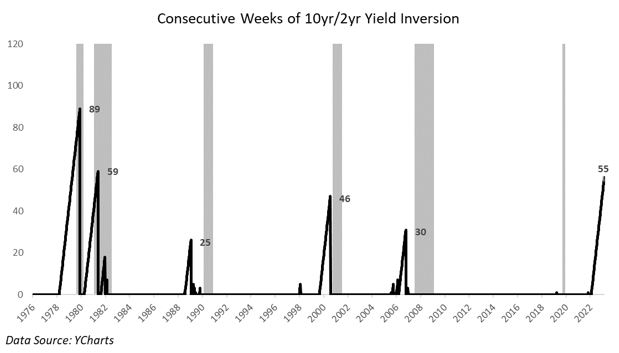

Though there aren’t many signs pointing to an impending recession, there is one indicator with a perfect track record that is- the inverted yield curve. Short-term interest rates have been higher than long-term rates for 55 consecutive weeks since last July.

Maybe we do get a recession and the market tanks, or maybe the market already tanked in anticipation of a recession that never came, and now it is rebounding in anticipation of growth accelerating.

Why does all of This Mean a Recession?

One explanation for why an inverted yield curve is a bad sign for the economy is straightforward and mathematical. Primarily, it’s because it slows bank lending activities.

Banks make money by borrowing short and lending long. That means, typically, the bank takes money you deposit at a low rate and lends it out to people who want longer-term loans — people buying a car, buying a house or a business looking to expand operations — at a much higher rate.

An inverted yield curve makes the math unprofitable for banks in many cases. That means they’re more reluctant to lend to businesses, which have a harder time expanding, which slows the economy.

But in another sense, an inverted yield curve presaging a recession is sort of a self-fulfilling prophecy. By moving money out of short-term bonds and into longer-term ones, investors are expressing the belief that an economic slowdown is coming sooner rather than later.

Whether this happens, and the severity of any potential downturn is anyone’s guess. However, it’s important to think in probabilistic terms and continue to keep portions of your investments exposed to potential growth, while keeping a portion sheltered from some of the wild swings in the equity markets.