Blog

“Who Holds the Student Loan Debt?“

I really enjoyed reading through this article from Nick Maggiulli at “Of Dollars and Data”. Check it out for this week’s newsletter.

Last week, President Biden announced a policy that would forgive $10,000 in student loan debt for those individuals earning less than $125,000 per year with an additional $10,000 in forgiveness for low-income students (i.e. those who received a Pell grant while in college). Following the announcement, there was a discussion of student loans and the efficacy of a loan forgiveness program. To add to this discussion, I decided to dig into the data on student loans and who would be most impacted by Biden’s recent policy proposal.

To start, let’s first examine how much student loan debt is actually out there.

How Much Student Loan Debt is There?

According to the most recent estimates, there’s $1.75 trillion in student loan debt across more than 43 million borrowers. This means that roughly 1 in 6 adults in the U.S. (17%) have student loan debt, with the average balance being around $41,000.

Who is this debt owed to? Mostly the U.S. government. According to the office of Federal Student Aid, $1.62 trillion, or 93% of all student loan debt, is federal student loans. The remaining $131 billion (7%) is owed to private lenders, according to this Q3 2021 report from MeasureOne. Therefore, for all practical purposes, the student loan problem is a federal loan problem.

This is why Biden’s policy proposal could have such a big impact on the student loan market—its biggest creditor is considering a huge write-off. How much of a write-off are we talking about? Current estimates suggest that Biden’s forgiveness program would cost around $300 billion, or about $2,300 per U.S. household. Though this burden would not be shared equally across all households, it provides some context for the cost of the program.

Now that we have looked at how big the student loan market is and how much Biden’s proposal might cost, let’s review who holds most of the student loan debt.

Who Does Most of the Borrowing?

When it comes to student loan debt, total borrowing is split basically 50/50 between undergraduate and graduate programs. However, after adjusting for population size, it’s graduate students that have the highest debt loads. As summarized in this review from the Brookings Institute:

About 75% of student loan borrowers took loans to go to two- or four-year colleges; they account for about half of all student loan debt outstanding. The remaining 25% of borrowers went to graduate school; they account for the other half of the debt outstanding.

This means that, on a per capita basis, the typical graduate student has roughly twice as much debt as the typical undergraduate student. And since we know that the average public university student borrows $32,880 to attain a bachelor’s degree, we can infer that the average graduate student borrows about double this (~$66,000) to obtain their graduate degree.

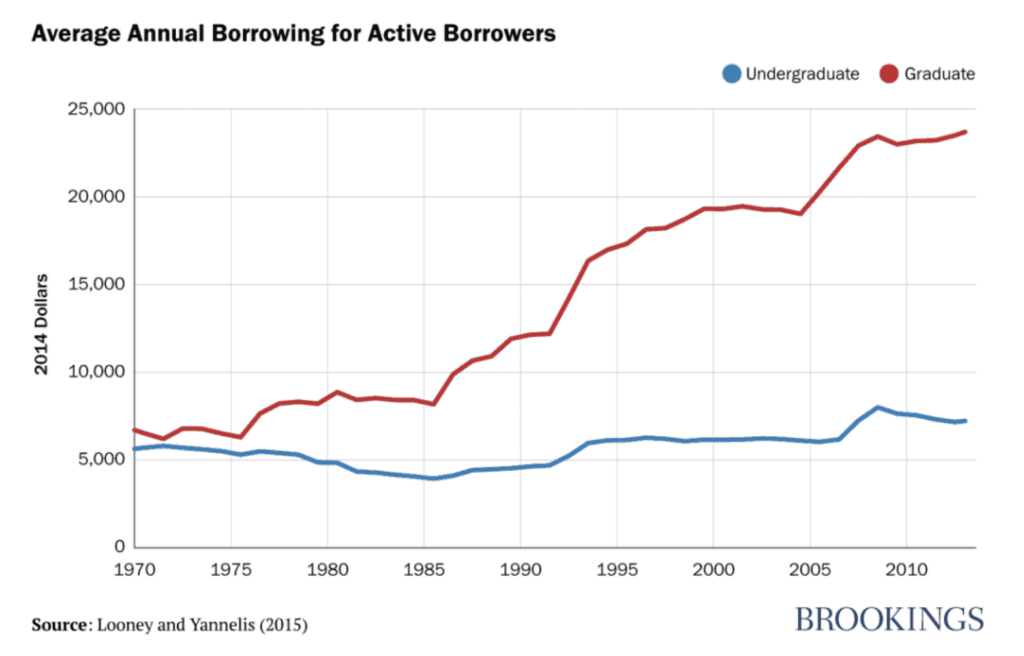

Looking at the trend of average annual borrowing by undergraduate and graduate borrowers, you can see why this is the case:

Even after adjusting for inflation, graduate school has gotten increasingly expensive and has led to far more annual borrowing than at the undergraduate level. As a result, graduate debt loads have gone up significantly over the past few decades.

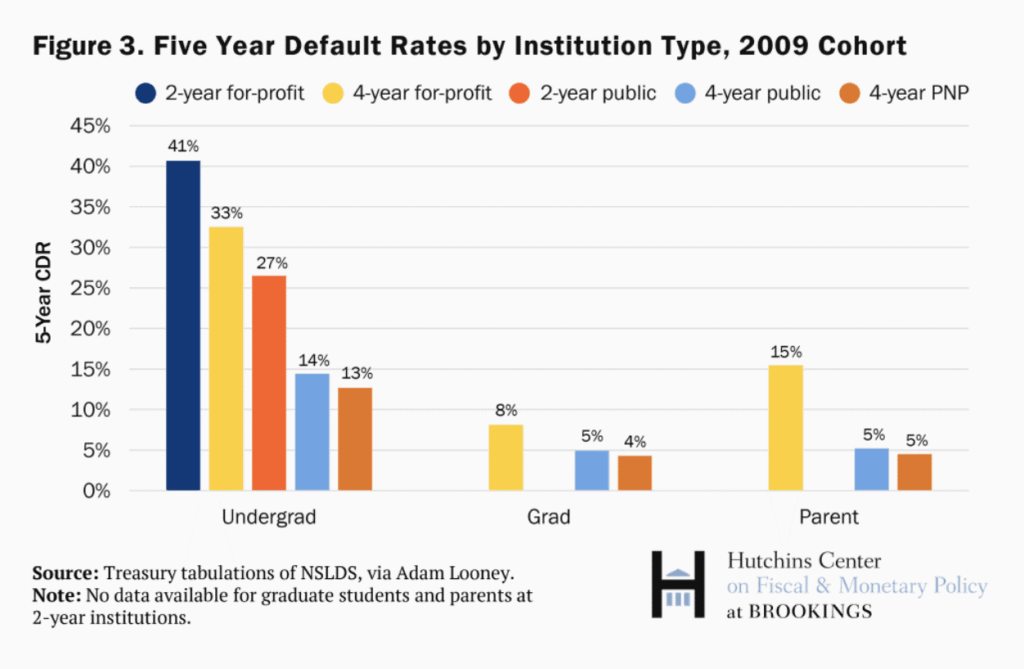

Despite this, graduate students have the lowest default rates among all student borrowers. Who has the highest default rates? Undergraduates who attended for-profit institutions:

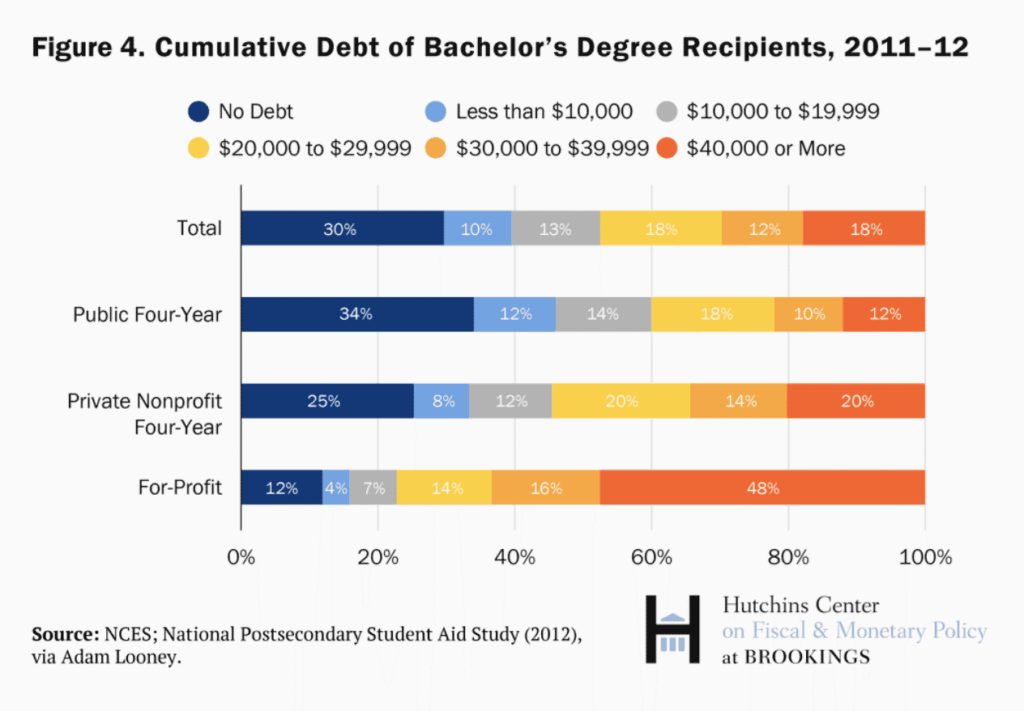

It’s not completely clear why undergraduates at for-profit institutions have the highest default rates, but debt load may be a factor. According to Kadija Yilla and David Wessel, nearly half of all undergraduate borrowers at for-profit institutions hold $40,000 or more in student loan debt. However, this is not the norm. As you can see in the chart below, the vast majority of undergraduate borrowers hold less than $40,000 in loan debt:

This implies that a small number of borrowers hold a disproportionate share of the total student loan debt. And this is exactly what we see in the data. According to Sandy Baum at The Urban Institute, only 6% of borrowers have over $100,000 in student loans, yet these borrowers account for 35% of the total student loan debt.

From these figures it is clear that those with the highest debt loads are typically graduates and undergraduates at for-profit institutions.

Nevertheless, for those that are struggling with student debt, is there a better solution than Biden’s proposal?

Is There A Better Solution?

I’m no political expert, but if I had to come up with a policy to help those most negatively impacted by student loan debt, the policy would be simple—let them declare bankruptcy. Let them wipe their debt clean.

Yes, this would have huge repercussions on the student loan market going forward, but it would also provide major relief to those who need it most. Additionally, if student loan debt was able to be included in bankruptcy it would also require the federal government and institutions to review the creditworthiness of borrowers more closely than they do today. This perhaps would be the biggest shift you could make and would force universities to really review the ROI of various majors and areas of study.

Regardless of how you might feel about these ideas, there are many good discussions to be had about how to fix the student loan problem. I can only hope that, despite the complexities involved, we find a solution that works for everyone. Happy investing and thank you for reading!