Blog

“Steps to Take Outside of Your Portfolio”

I realize the message of “staying the course” can get a bit mundane and repetitive when we are going through market corrections like we are seeing right now. However, it can sometimes be helpful to consider things you can do that ARE within your control. In other words, what are some areas I can re-assess and look at that are outside of my investment portfolio while we are in this down market? For the article this week, I enjoyed reading what Nick Maggiulli had to say in his most recent article:

It’s official—we’ve entered a bear market. With the brutal selloff last week, the S&P 500 is now 23% off its highs. But what makes this bear market particularly difficult is that many other asset classes have sold off as well. Over the last year U.S. bonds, U.S. stocks, and crypto have all experienced declines in the double digits.

With all this market turmoil, you might be wondering: what should I do with my portfolio?

While this is a decent question to ask, I don’t think it’s the best question to ask. Why? Because the evidence suggests that any big changes to your portfolio are unlikely to pay off. I demonstrated this when examining how different asset classes perform after yield curve inversions, but we see the same thing when examining how different asset classes perform after periods of high inflation as well.

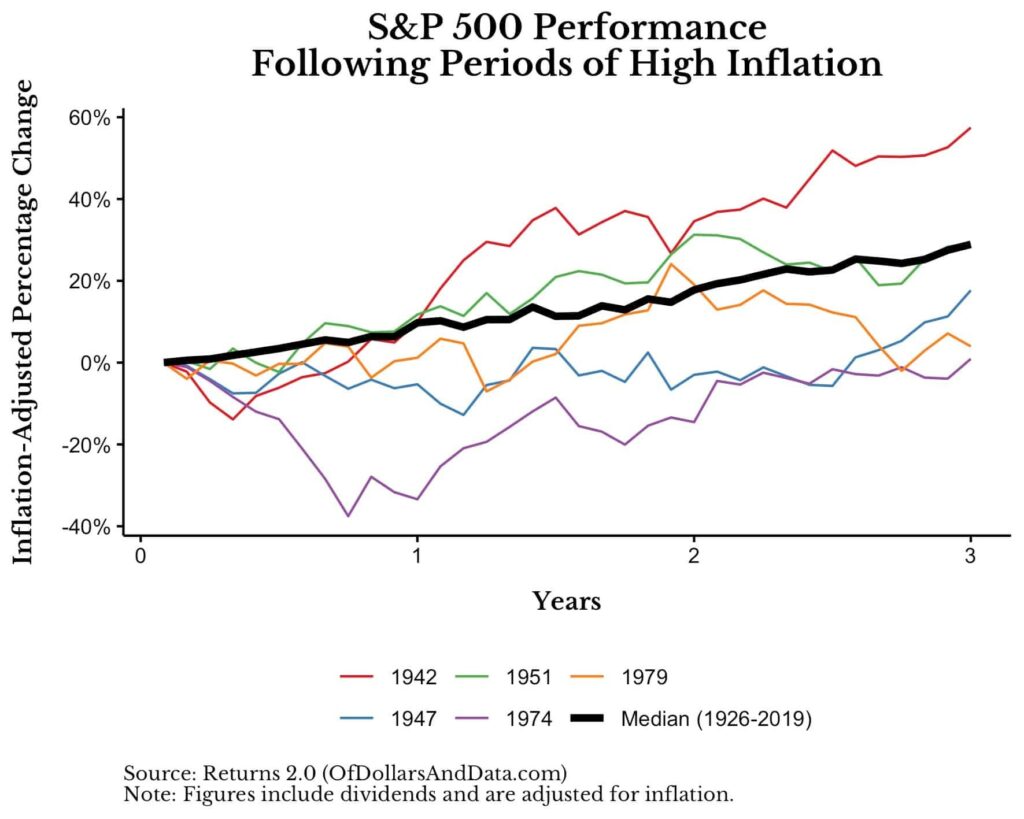

For example, if you look at real U.S. stock performance going back to 1926, you will discover that stocks tend to underperform their historical averages following a period of high inflation. As you can see in the chart below, there were five years where inflation initially passed 8% and real U.S. stock performance was a bit lower over the next three years when compared to the median U.S. stock performance over-all three-year periods in the data:

In fact, the median real performance of U.S. stocks over three years is a +28% compared to only +17% in the three years after a period of high inflation.

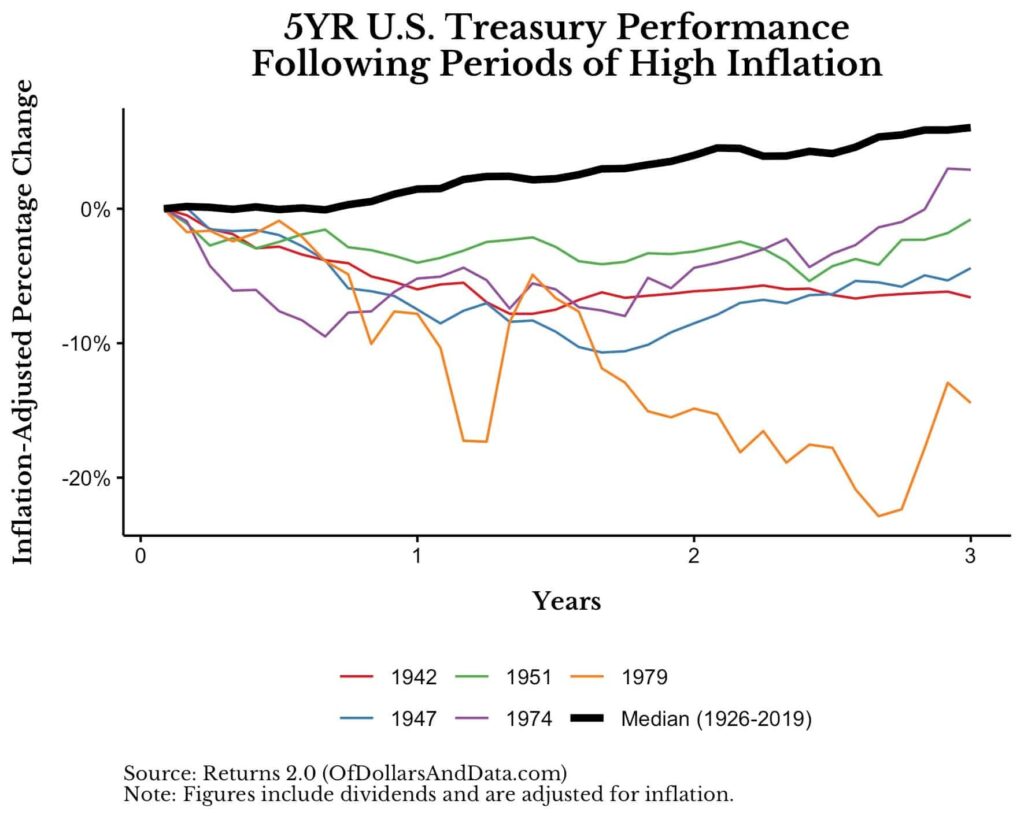

Given this, you might think that selling your U.S. stocks and moving to U.S. bonds would be the right move. But the data suggests that this would be a terrible idea.

Following a year of high inflation, U.S. bonds significantly underperformed over the next three years when compared to their median performance in all other three-year periods:

This makes logical sense as high inflation will devalue a currency (i.e. cash) and also devalue lender assets, such as bonds, as well. As a result, the most sensible portfolio action to take is no action at all. Stay the course. Just Keep Buying (if you can).

So, instead of asking, “What should I do in my portfolio?” Ask, “What should I do outside of my portfolio?”

Because, in the grand scheme of things, your investment portfolio is just one part of your financial picture. There are many other levers that you can pull if you want to improve your finances. However, those levers will be dependent on where you currently are in your financial journey.

Some of you are accumulators and have the ability to save money, while others are retirees (or soon-to-be retirees) and may have a harder time saving money. To that end, I have summarized the tactics that both groups of investors can use during times like these. With that being said, let’s start with the accumulators.

What Can You Do (as an Accumulator)?

- Buy More. If you are still in the saving part of your financial journey, the current decline is likely to be a long-term benefit to you because you will be able to acquire more shares of diverse, income-producing assets at cheaper prices. This will require you to temporarily cut your spending or increase your income, but, if you can do either of these, you will be rewarded in the long run. Don’t just take my word for it though, the math supports it too.

- Learn New Skills. If you’ve ever considered learning a new skill or going back to get a degree, a downturn could be the perfect time to do so. Not only would you get to wait out a possible economic storm, but you would also increase your future earnings potential as well. It’s a win-win. More importantly, you don’t have to do this through a formal education program either. You can volunteer somewhere or take an internship if it would benefit you in the future. Remember, during a downturn its much harder to say “No” to cheap labor.

- Consider Starting a Business. If you have been thinking about starting a business for a while, a downturn could provide you with the right opportunity. Not only will you be able to negotiate more with suppliers, but you can be more nimble and take bigger risks than your competitors (since you have less to lose). Of course, starting a business is risky, but there are lots of reasons why downturns can be beneficial to those who have wanted to start a business.

- Improve Your Non-Financial Life. Lastly, instead of focusing on how you can use a downturn to improve your finances, why don’t you take this time to re-assess your priorities everywhere else in life? Whether it’s your health, your relationships, or your social life, it’s always good to re-examine what matters most to you when times are tough.

Now that we have discussed what accumulators can do to improve their lives during a downturn, let’s turn our attention to those later in their financial journey—retirees.

What Can You Do (as a Retiree)?

- Work Part-Time. If a downturn has got you worried and you haven’t worked in a while, working part-time to earn supplemental income is a great way to put your mind at ease. While this isn’t ideal, I know that there are many retirees who work part-time as a way to mitigate rising costs and decreased asset values. Not only can this help you financially, but many retirees talk about the social and mental benefits of staying active and being engaged in the workplace in some form or fashion.

- Lower Your Spending. If you don’t have a way to earn supplemental income during a downturn, then one of the best levers you can pull on is your spending rate. Lowering your spending (even if just temporarily) is a great way to make it through tougher economic times. While I don’t preach this advice often, extreme times call for extreme measures. More importantly, the data suggests that lower spending in retirement isn’t that uncommon. As I stated in Ch.9 of Just Keep Buying, “spending in retirement typically [declines] by about 1% per year.” So, if you are already spending less, it may not be that much of a jump to lower your spending (temporarily) to get through an economic slowdown.

- Be Flexible. Instead of lowering your spending, you could consider delaying it until asset prices recover a bit. By building some flexibility into your retirement plans you may be able to weather a downturn without giving up on your goals. Of course, this is easier said than done. However, for younger retirees or those retirees in excellent health, I’d strongly consider being flexible when times are tough.

Bottom Line

No matter what the markets throw at you, there are always ways in which you can improve your situation. Whether that means changing your spending, your career, or something else entirely, please remember that you have options. These options may not always be obvious to you, but they are definitely there. As I have stated before:

Investing isn’t about the cards you are dealt, but how you play your hand.

Think outside the portfolio. Happy investing and thank you for reading!