Blog

“Mid-Year Outlook”

It’s hard to believe we are already halfway through 2022. Growing up, the 2020’s felt like a decade that belonged in sci-fi movies or an age where we would surely be in flying cars and living in outer space. And while we aren’t necessarily at that level, the world has changed quite dramatically. Frankly you only have to go back six months to see that things looked very different. Right now, we are living through a pivotal time marked by geopolitical realignment, high inflation, volatile financial markets and the end of a 40-year period of declining interest rates. Despite all of these challenges, I remain optimistic about the future investing environment. I particularly like this quote from Rob Lovelace, Vice Chair and President at Capital Group,

“First, there are still signs of growth as the global economy recovers from the pandemic. Second, I believe corporate earnings will be the driving force of equity markets going forward, as opposed to multiple expansion — a welcome return to fundamentals. And third, I think we will experience a healthy recession in the next year or two. For all the concerns about it, I see a moderate recession as necessary to clean out the excesses of the past decade. You can’t have such a sustained period of growth without an occasional downturn to balance things out. It’s normal. It’s expected. It’s healthy.”

With the above in mind, here are some trends as we look forward into the second half of 2022 and beyond:

Expect More Volatility

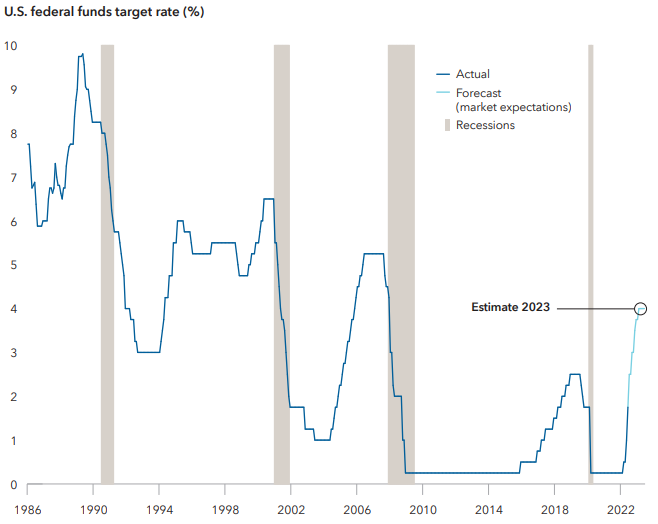

Sharply higher inflation has prompted the U.S. Federal Reserve and other central banks to raise interest rates. But how high will they go? Will soaring consumer prices force central bankers to tighten monetary policy beyond current expectations? Or will they back off as higher rates start to take a toll on the economy? In the past, the Fed has reversed course in the face of painful market gyrations, daunting geopolitical events or, most recently, a pandemic. But Fed officials may not have that kind of flexibility anymore, with inflation running at a 40-year high. “We are seeing a significant deviation from the standard Fed playbook we’ve become accustomed to over the past few cycles,” says Tim Ng, a fixed income portfolio manager at Capital Group. “And the reason is clear: Inflation is far too high.” Investors should brace for a bumpy ride, Ng explains, as the Fed and other central banks grapple with how to bring down inflation without pushing the global economy into recession.

A Return to Quality for Equities

When market volatility is rising, boring is beautiful. That’s why many dividend paying stocks today are compelling, if dull and dependable, investment opportunities. Global companies paid out a remarkable $1.9 trillion for the 12 months ended May 31, 2022, as measured by the MSCI ACWI (All Country World Index). That represents a 20% jump from the prior 12 months. “In this low-growth, inflationary environment, I am focusing on companies with manageable debt and sustainable dividends,” says Caroline Randall, an equity portfolio manager. “We are finding many across a range of sectors that are increasing dividends 10% a year.” Proven dividend growers can help bolster investment returns when inflation is rising. “I look closely at what companies actually do with their dividend, rather than just what they say they will do,” says Randall. “Dividend growth commitments are a critical signal by management about their confidence in the future earnings growth potential of their company.” Companies paying growing dividends can be found across the financials, energy, materials and health care sectors, among others.

Fixed Income can Again Play a Role

There’s no sugar coating it — early 2022 was not a great time for bonds. The core benchmark, the Bloomberg U.S. Aggregate Index, was down more than 10% through mid-June, the worst period in roughly 40 years. The highest inflation in decades thrust the Federal Reserve into rate-hiking mode. But current bond prices now reflect that pain. During and after Fed hiking periods, more yield helps boost returns. This is part of the reason hiking periods realized an average return of 2.3%. Then there’s the recovery: The first and second year after those periods saw average returns of 13.2% and 12.6%, respectively

The yield on the 10-year U.S. Treasury surpassed 3% in June for the first time since 2018. Yields, which rise when bond prices fall, have jumped across bond sectors as central banks seek to quash inflation. Over time, rising yields mean more income from bonds. At today’s yields, history suggests higher total returns over the next few years.