Blog

“Is Now the Time for Individual Stocks?“

This post was certainly relevant when we first wrote it back in April of 2020. However, over a year later, and a reminder of how picking individual stocks usually pans out can be valuable. It’s not that individual stocks are inherently bad. However, it is really challenging to consistently pick “out-performers” over long periods of time.

Original Post from April 2020

As people across the globe are being told to stay put in their homes, it’s not surprising to see some companies suffering more than others. Our normal routines are turned upside down, and so are our normal consumer spending habits. Not only is this the case for your city, but this is affecting your state, our country, and the entire world!

At the end of the first quarter, some brick and mortar retail stocks were down off their highs by more than 80%! Many well-known travel stocks were experiencing catastrophic losses too. Meanwhile, investors also sold off shares in oil stalwarts in response to a variety of market dynamics that actually pushed the cost of a barrel of oil into negative territory this past week. Yes, that is right…oil producers were literally paying people to take produced oil off of their hands! You may look at these industries with steep declines and think to yourself, “There’s no way these companies are going out of business. This dip is temporary and it’s inevitable that they’ll bounce back.” However, any time you start making investment predictions like these, you’re in dangerous waters.

The Problem with Betting on Single Stocks (Even If They’re “on Sale”)

From a starting point of feeling certain that some companies will obviously withstand the current economic shockwaves, it’s not a large mental leap to thinking about the potential upside of betting on a few stocks or sectors. Plus, it sounds relatively easy: buy in when shares are discounted and then ride the wave back up to the top. That idea of having your wealth explode from capitalizing on these opportunities is seductive, no doubt. But it’s also unrealistic.

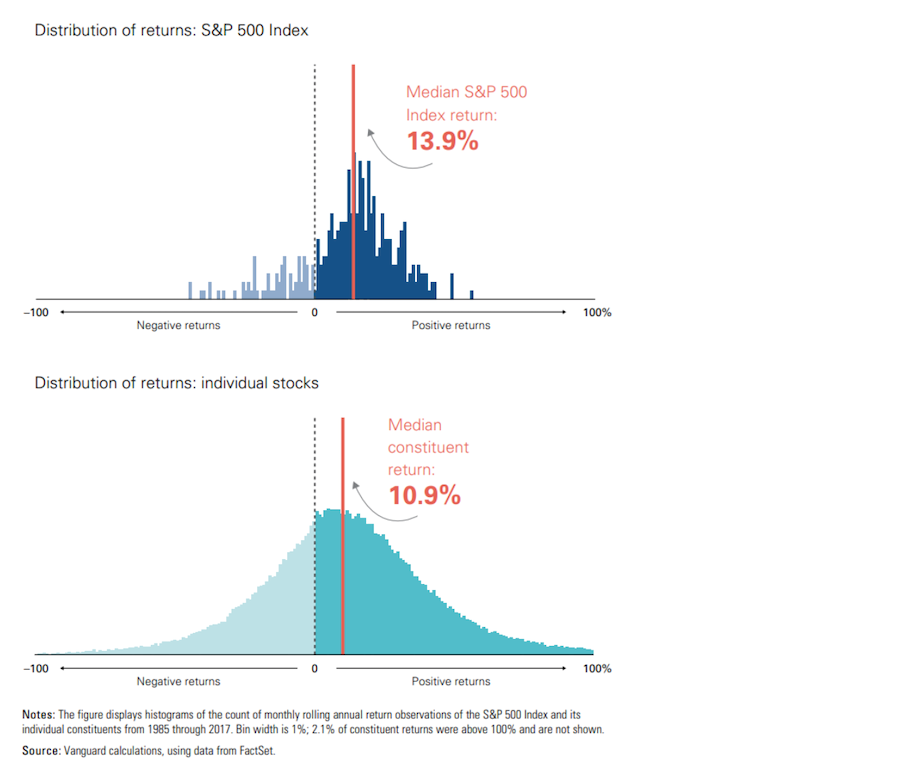

Consider the points that Daniel Crosby makes in his book, The Laws of Wealth. As Crosby explains, “History tells us that the odds are twice as great that you’ll go broke on a single stock as you will hit it big.” Research from Vanguard agrees. The charts below plot the distribution of monthly rolling annual returns of the S&P 500 Index (top chart in dark below) and its individual constituents (bottom chart in teal):

Not only is the range of returns for the stock market narrower, but 75% of the time the return of the S&P 500 was greater than the median individual constituent return. Meanwhile, the range of outcomes in the bottom half of the distribution for individual stocks shows how painful holding the wrong individual stock can be.

When Feeling Tempted, Consider Your Personal Benchmark for Success: Ability to Achieve Goals

Where we lack certainty, we can turn to probability. Probabilities give us a rational way to make decisions about a completely unknown future, and the probabilities in this situation suggest it’s best to stay away from stock-picking. However, even if you were to ignore those probabilities and gamble on an individual stock or two, how would it change your life if you happened to pick a massive winner? Would you retire early? Buy a yacht?

My guess is it wouldn’t change anything. The only way it could change your lifestyle (currently or in the future) is if you bet an outsized portion of your net worth on individual securities or specific sectors. Given the probabilities, I think you would agree betting a large percentage of your net worth in this manner is simply irresponsible. If you guess wrong and have a large amount of your wealth wiped out, can you afford to start over from scratch — only this time, without the benefit of the longer time horizon you enjoyed when you first began investing? If you still want to buy individual stocks or sector-specific funds in an effort to hit a home run, and you know it won’t change your lifestyle if you’re right – then I’d ask the most important question: What’s the goal?

Meanwhile, remember: a good financial plan doesn’t require you to hit home runs. It merely requires you to earn a decent return that compounds its way into exponential wealth growth. Good investing is boring. If you’re having more fun watching your portfolio than watching paint dry, you may be doing it wrong.