Blog

“In Good Years the Market Still Goes Down“

It’s a simple thought, but I really enjoyed this article from Ben Carlson over at A Wealth of Common Sense. I hope you enjoy it too:

The S&P 500 is up just shy of 17% so far in 2023.

Maybe these gains will stick (or get better) or maybe the market will roll over. Nobody actually knows.

The stock market is unpredictable, especially in the short-term. But it’s important to understand that even in the really good years, there’s a decent chance you’ll have to live through a correction along the way.

Since 1928, the S&P 500 has finished the year up 10% or more 55 times. In 23 out of those 55 years, there has been a correction from peak-to-trough in that same year of 10% or worse.

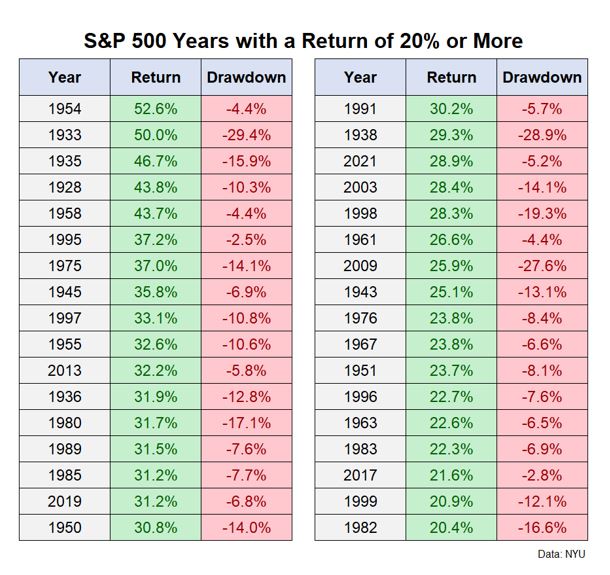

In that same time frame, the stock market experienced 34 years with gains of 20% or more. Out of those 34 years, there has been a correction of 10% or worse on the way to those gains in 16 years.

So, in almost half of all years when the U.S. stock market is up by 20% or more, there has been a double-digit correction during the journey to those wonderful gains.

If you don’t believe me here is the data:

So far this year the worst we’ve had to endure in the S&P 500 is a drawdown of a little less than 8%.

Maybe we get something worse than that, maybe not. Stocks can be volatile because people can be volatile.

One of the strange things about investing in the stock market is that while the trend is usually your friend, you always have to be prepared for countertrend moves.

Even in the worst market crashes, you have to prepare yourself for the occasional bear market rally.

Even in the most hard-charging bull markets, you have to prepare yourself for the occasional correction.

And of course, there are those regime changes when bear market or bull markets come to an end and you have to prepare for an entirely new investing environment.

Risk and reward are attached at the hip when it comes to investing. One of the reasons the stock market provides such lovely returns in the long-run is because it can be so darn confusing in the short-run.

You don’t get the gains without living through the losses.