Blog

“House Rich but Cash Poor”

If you are like many other Americans who have owned a house over the past ten years, you’ve seen very nice appreciation and therefore equity build-up in your home. While this shows up on a Net Worth statement, it oftentimes doesn’t lead to less financial anxiety because you can’t exactly use your equity to buy groceries or pay for your kids’ school expenses. So, while the appreciation is nice, being house rich but cash poor is a very common problem. This recent post from Ben Carlson highlights some of the key figures in the recent house price run-up and offers some high-level thoughts about what you can do to tap into your equity if push comes to shove.

According to the National Association of Realtors, the median price of a house in the United States is worth $190,000 more than it was a decade ago.

If you’ve owned a house for more than 3 years or so, you’re likely sitting on some nice gains.

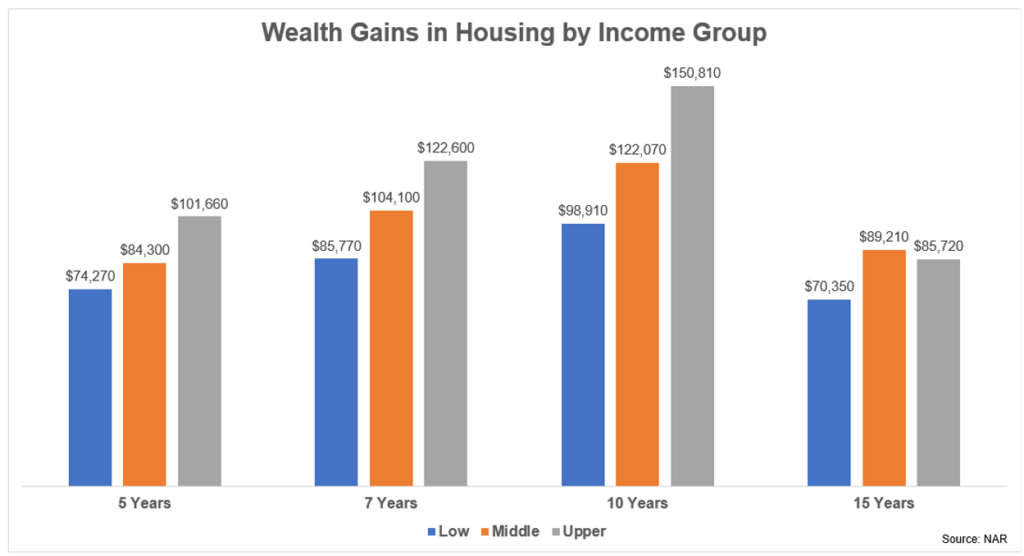

Those gains were not evenly distributed but across the various income levels, homeowners have made a good chunk of change:

The pandemic-related housing gains are unlike anything we’ve ever seen before so it’s not like you should expect this to continue.

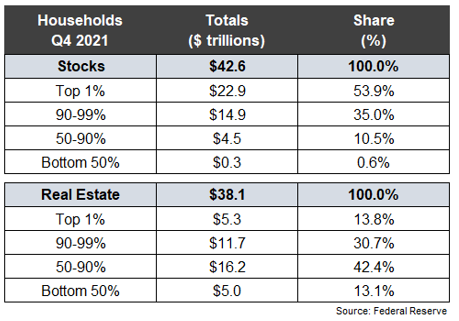

But the housing market is more important for the middle class than the stock market for the simple fact that ownership of residential real estate is more widespread.

The top 10% controls nearly 90% of the stock market while the bottom 90% owns more than 55% of the housing market:

It’s no fun for those who have missed out on the gains we’ve seen during this cycle but this is a good thing for those who don’t hold as many traditional financial assets like stocks and bonds.

There is, however, a problem with having your wealth so concentrated in your home.

For one thing, the wealth gains cited in the research by the NAR are on a gross basis.

You have to net out all of the ancillary costs involved with homeownership to get the real number. Things like realtor fees, closing costs, property taxes, moving expenses, insurance, upkeep and maintenance can take a huge bite out of any nominal price increases.

Plus, having your wealth tied up in your house is much different than owning financial assets or having that money in the bank.

A home is an illiquid asset. It’s difficult to tap your equity. There are many options but none of them are a slam dunk:

- You could open up a home equity line of credit or do a cash out refinance but that requires borrowing more money.

- You could use your equity as a down payment for a new home but that also means paying the now higher housing prices.

- You could sell your house to either downsize or become a renter but you’re always going to have to live somewhere.

- You could perform a reverse mortgage when you retire but that’s a complicated process.

- You could live somewhere else and rent out your home to provide some income but there are still a lot of costs and potential headaches involved in that process (and again you have to live somewhere).

I’m not trying to talk people out of owning a home. There are plenty of benefits to being a homeowner.

It’s a form of forced savings. It’s a good hedge against inflation. It allows you to lock in a fixed monthly cost and grow into your payment over time. And there is the psychic income component that comes from making it your own and living in your desired community.

Obviously, rising housing prices are better than the alternative if you own your house. The gains we’ve seen have helped households in the middle and lower class build wealth in a big way over the past decade or so.

But unlocking the value in your home is not as easy as one might think.

Building wealth in your home is nice but it’s important to diversify into other financial assets as well.