Blog

“Are we in an AI Bubble”

The question of whether or not we are in an AI bubble is something that has been on many people’s minds over the past 6 months. Tech stocks seem to be carrying the market as evidenced by the fact that the top 7 companies in the S&P 500 represent about 32% of the index weight of the entire S&P 500. Said another way, the other 493 companies represent about 68% of the index’s weight. The truth is that nobody truly knows exactly how the AI fervor will play out, but I thought a recent article by Chris Buchbinder over at Capital Group did a great job of breaking down how he is thinking about the current AI landscape. Enjoy reading:

In the past few weeks, I have been struck by the volume of media coverage focusing on whether investor enthusiasm for artificial intelligence is driving the market toward an “AI bubble.” Television news magazine 60 Minutes recently covered the topic in depth with a considerable amount of alarm.

Since I wrestle with this question myself, I thought it would be helpful to share my views — not only as an investor in AI-related stocks, but also as a former telecommunications analyst who witnessed the bursting of the tech bubble in the late 1990s. I still have vivid memories of that experience, and it taught me lessons I believe are applicable to the current environment.

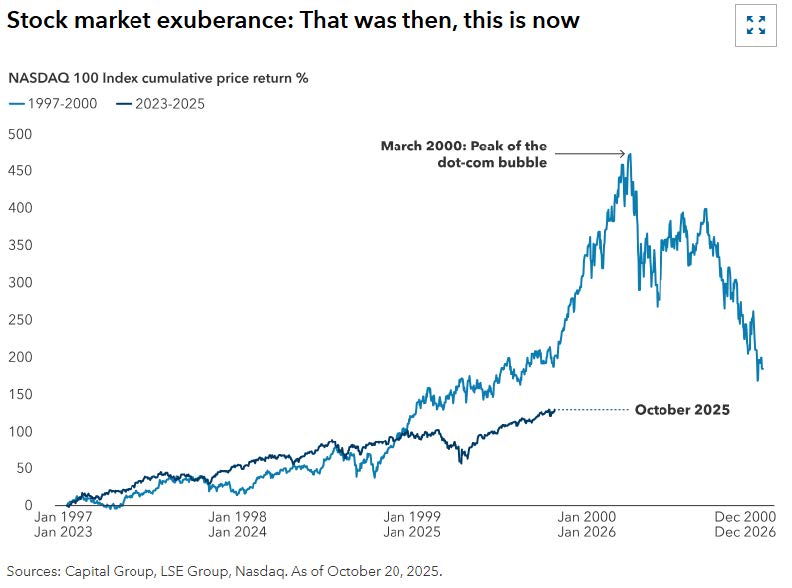

The key question today is whether the appropriate analogy is the year 2000, which would imply that we are in a bubble that could be about to burst, or 1998, which would imply that we haven’t seen the major inflection point yet and the market may still have room to run.

While I acknowledge the difficulty of assessing bubbles with foresight, I believe we are closer to 1998 than 2000. As some may remember, 1998 was the year that Global Crossing — the defining company of the fiber-build era and one of the linchpin stocks of the late ‘90s bubble — came public at $19 per share. Nine months later, it was trading at $61. WorldCom famously reported that internet traffic was doubling every 90 days. Of course, both companies later went bankrupt, but not before staging a spectacular run. From the time Global Crossing went public on August 14, 1998, until the market peaked on March 10, 2000, the tech-heavy NASDAQ-100 Index rose more than 245%.

Sitting out that period was very painful for experienced portfolio managers who were skeptical about the growing bubble as they were left behind by the market rally. They were ultimately vindicated in 2000 and beyond, but the journey was unpleasant.

Will history repeat itself?

Down the road I think there is a substantial probability that we will see a bubble at some point, followed by a potentially gut-wrenching correction. But I don’t think we are there yet. History may rhyme, as Mark Twain once supposedly said, but it doesn’t repeat itself exactly.

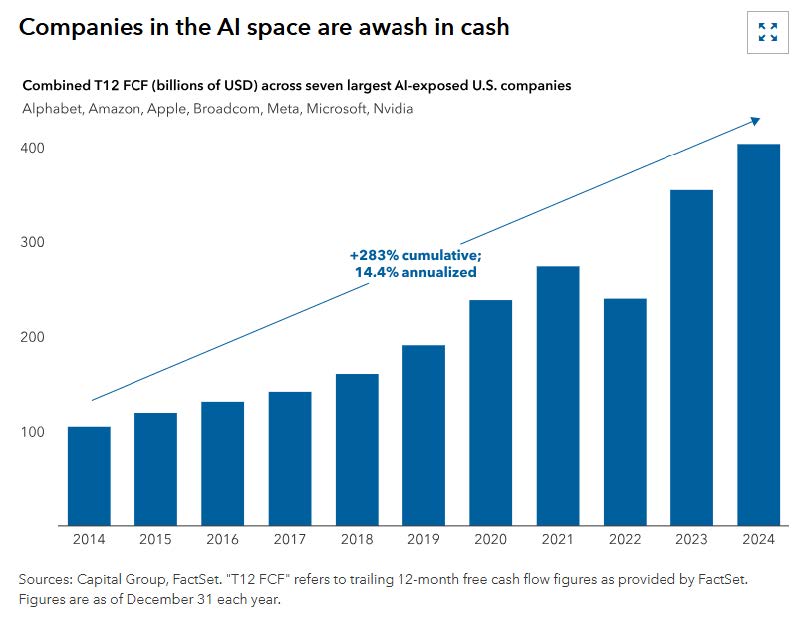

Today we have a much more robust set of companies making AI-related investments. The giant hyperscalers — the providers of internet and cloud platforms such as Amazon, Microsoft and Alphabet — can support their massive capital spending far better than the telecom upstarts of the late ‘90s. Some economists say the spending on AI-related investments, which include purchasing advanced chips and building massive data centers, has helped keep the U.S. economy out of a recession this year.

By some estimates, the AI spending cycle is so large that it accounts for roughly 7% of U.S. gross domestic product, or more than $2 trillion. This enormous spending is necessary in the view of the Big Tech incumbents if they are going to avoid being disrupted by the younger, upstart AI companies. As long as companies such as Amazon, Microsoft and Alphabet see AI-related spending as existential, I believe they will continue to invest, and that will continue to fuel the AI boom.

Missing piece: The pending IPO boom

Another significant difference today is that we haven’t seen the leading company of this era, OpenAI, go public just yet. OpenAI launched the latest round of investor enthusiasm in November 2022 with the unveiling of ChatGPT, an AI-powered chatbot that became the most downloaded app in history at the time. Other innovative startups — including Anthropic, Cohere, Mistral AI and xAI — remain private as well, for now. We haven’t had our “Global Crossing moment” yet, but I believe it’s just a matter of time before these startups enter the next stage of their growth through the initial public offering (IPO) process.

One of the elements that inflated and sustained the ‘90s tech bubble was accelerating revenue growth, with promises of profitability later. These pre-IPO companies are the modern-day equivalent. When they eventually go public and investors get a more detailed glimpse into their financials, high growth rates are likely to be rewarded by the market.

In addition, it’s worth noting that the U.S. Federal Reserve is currently engaged in a rate-cutting cycle. Loose monetary policy can provide a tailwind for highly valued technology stocks. In 1998, Fed officials started slashing interest rates aggressively after the collapse of Long-Term Capital Management. They maintained low rates amid widespread fear over the year 2000 bug. Today, you could argue that tariffs and a weakening labor market are the equivalent concerns prompting the Fed to take action. In any case, then as now, there is a great deal of liquidity in the system, and that tends to fuel the animal spirits of investors.

What if the AI bubble is about to burst?

Another lesson I’ve learned from three decades of investing is that the market will humble you at times. It’s entirely possible that I am wrong about the scope and timing of an AI bubble. In my portfolios, I am investing like we are somewhere in 1998 or 1999, with the intent of fully participating in the powerful AI trends as they continue to unfold among these dynamic, growth-oriented companies. However, I am also playing defense, seeking to add some degree of balance to my portfolios.

In that light, I am actively looking for companies that may be out of favor today but could do relatively well if the AI bubble pops. I think energy and cable companies fall into this category. Both of those sectors are trading near historically low valuations. And both contain select companies with decent earnings, valuable long-term assets and the potential for upside surprises.

The energy sector, for example, makes up about 2.8% of the S&P 500 Index today. That’s only slightly higher than it was during the depths of the COVID crisis, when oil prices briefly fell below zero. It’s never been that low as far back as the index data goes. This area of the market has, in effect, been left for dead, and that indicates to me the level of pessimism may have gone too far.

Similarly, with the rapid decline of cable television, cable stocks have been unloved for a long time. But for investors willing to sift through the sector, I think there are some overlooked gems with growing businesses and healthy cash flows trading at very low multiples.

I am not ringing any alarm bells, but this is how I am hedging against AI-related risk in my portfolios.

Looking ahead for bubble trouble

None of my comments should be construed to think that I am unconvinced about the rapid advancements in AI and its potential to be an incredibly transformative technology. I am not an AI skeptic. I believe it will change the world, just like the internet changed the world. I believe it will set the stage for the creation of new, innovative and disruptive companies, the same way the advent of the internet paved the way for Amazon, Alphabet, Meta and Netflix.

But I also think it’s important to assess where we are along the path of AI adoption, investor enthusiasm and the possibility that there will be trouble ahead. If we are on the way to bubble territory, then it really matters where we are on that timeline. I would argue we are closer to the early stages. And if you look at the history of the late ’90s tech bubble, then you may reach the same conclusion as me: That it’s probably too early to let the risk of bubble trouble overcome the compelling opportunities presented by this powerful new technology.