Blog

“Understanding How Dividends Work”

I sometimes feel that dividend investing is a very misunderstood part of the stock market. While there are certain benefits to investing in stocks that pay a consistent dividend it isn’t the be-all end-all of investing. Unfortunately, many people’s closely held beliefs of how dividends work are actually wrong. I don’t blame individuals though; the internet is loaded with article after article of how dividend investing is a “safe” way to find retirement income and that somehow the actual stock price of the company is unaffected by paying out the dividend. In this article we will explore some of the downsides of dividend investing. This isn’t meant to suggest that dividends are bad, but more to provide a counterbalance to what you may have read or heard in other areas of the internet.

Issue 1: Dividends Increase Your Taxes

The first problem with dividend investing is that it increases your taxes in a non-retirement account. Taxes are usually not an issue in a tax-advantaged account, such as an IRA, Roth IRA, or 401(k), but in a brokerage account, dividends can increase your taxes.

When a dividend is paid, you are taxed on it, whether you reinvest the dividend or take it as cash. It doesn’t matter whether you leave it in the brokerage account or take it out. It will be taxed.

How it is taxed depends on whether it is qualified or nonqualified.

Qualified dividends are taxed at preferential capital gains tax rates. Nonqualified dividends are taxed at ordinary income tax rates.

Capital gains tax rates are 0%, 15%, or 20%, depending on your other income and which bracket you fall into. Ordinary income tax rates range between 0% and 37%.

In order for a dividend to be qualified, it must:

- Be issued by publicly traded US companies

- An investor must own the stock for more than 60 days out of a 121-day period beginning 60 days before the ex-dividend date

The last bullet is complicated, but a general way to think about it is if you have held the stock for a few months, the dividend will likely be qualified.

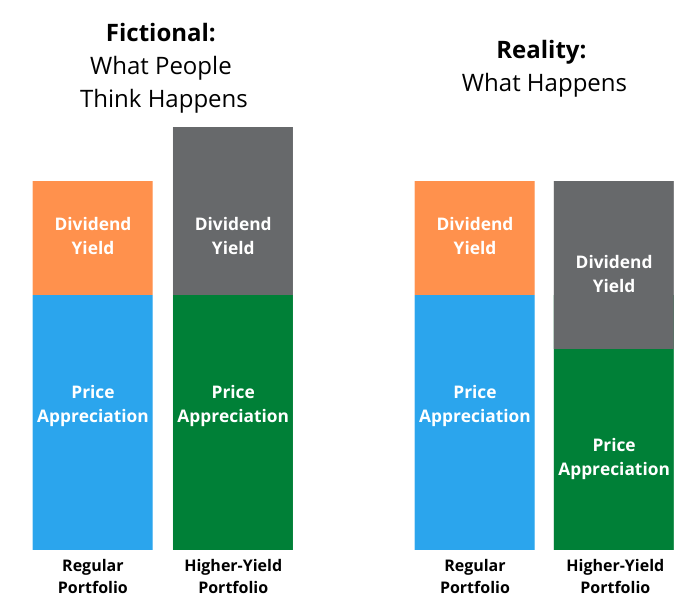

Issue 2: Dividends are Not Free-Money

Dividends are not free money. They don’t magically come out of thin air. As the old adage goes, “There is no such thing as a free lunch.”

Let’s look at a simple example.

If Company A is worth $100, has no debt, and pays a $5 dividend, how much will it be worth after it pays the dividend?

The answer is $95.

After the company pays $5, it has $5 less on its balance sheet. It can’t pay the $5 dividend and still be worth $100. If it could, that would be like me giving you $5 out of the $100 in my wallet and still thinking I have $100 in my wallet.

The reason people get confused about dividends not being free money is that stock prices move constantly while the stock market is open. It’s harder to see on the day that a company pays a dividend that it is declining in price by the same value because other forces are at play.

If really positive news comes out on the day the company pays a dividend, it may go up by a similar amount. For example, if Company A announces they have a new partnership in the works that will be positive for the company, they may go up in value by $5 on the same day they pay a $5 dividend.

If you just looked at the stock on that day, you might think that you have the same company worth $100, but you also received $5 as a dividend. It actually looks like the dividend was magically paid.

Issue 3: Dividends Reduce what the Company can Reinvest for Growth

Another issue with dividend investing is that companies that pay dividends have less money to reinvest for growth. Essentially they are admitting that they don’t have ideas to increase the value of the company, which usually means they are done growing as fast.

Another way to look at it is that they are saying, “We don’t have a responsible way to use this money and it would be better in your hands.” Then, you become responsible for deciding what to do with that income – whether it’s investing it or spending it.

Since dividend companies tend to be more mature, their better days are usually behind them, and this can show up in performance.

While not every company can or should be a growth company, it’s at least intellectually honest to know why a company would pay out a dividend and what that can suggest about where they are in the lifecycle of business.

Again, dividend investing isn’t necessarily bad but it’s important to understand how dividends actually work. Like any area of investing, knowing both sides of the argument can help you make a better informed decision going forward.