Blog

“The Housing Issue for Younger Americans”

For many of our clients, housing and the growth of their primary residence (and potentially investment properties) was a large contributor to their overall financial success. Yes, we all know that interest rates were much higher in the 1980’s but the ratio of house price to income has changed dramatically. In 1980, the median household income was around $21,020 and the median price of a home was $64,600. This represents a ratio of 3.07.

In 2023, the median household income has jumped to $80,610 and the median house price to $428,600. This represents a ratio of 5.32. A significant change for sure.

Ben Carlson over at “A Wealth of Common Sense” recently wrote on this topic and shared some valuable insight in his piece. He does a good job laying out how these changes have pushed up the average age people are becoming homeowners, but also why it doesn’t seem to be a top priority for policymakers right now. Enjoy reading his article…

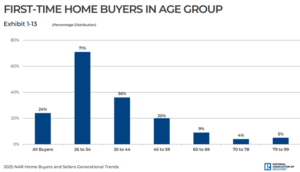

According to the National Association of Realtors, first-time homebuyers made of just 24% of recent transactions:

That’s the lowest on record since the NAR has been collecting this data since 1981. Nearly three-quarters of recent buyers did not have a child under the age of 18 in their home, the highest share on record.

It’s a terrible time to be a young person in search of a house.

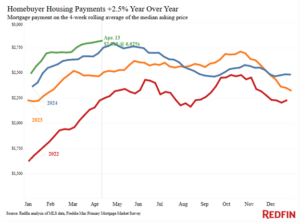

Just look at the latest data from Redfin for the monthly mortgage payment on a median home at prevailing interest rates:

The median monthly payment has nearly doubled since the start of 2022 alone. Things are even worse going back to 2020 or 2021.

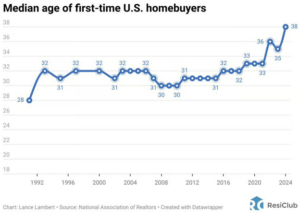

The outcome here is the median age of first-time homebuyers has gone way up in recent years. Here’s the trend from Lance Lambert:

It’s increased from 33 in 2020 to 38 now.

Nearly 30% of people 26 to 34 who were able to buy a house needed help with the down payment from a relative or friend.

When you combine the massive increase in housing prices with the massive increase in mortgage rates, this is likely the worst time ever to be a first-time homebuyer. Sure, if you buy now and can refinance at lower rates down the line things will probably work out for you just fine.

But many young people simply can’t afford to buy right now because down payments are too high and borrowing costs are too onerous. It has to be such a frustrating situation because it’s not your fault if you were born a few years too late for the biggest housing boom in history.

I know plenty of young people are angry about housing costs but this doesn’t feel like an issue that’s top of mind for local governments, the federal government or policymakers. Everyone knows housing it cost-prohibitive for young people but no one is really doing much about it.

Why is that?

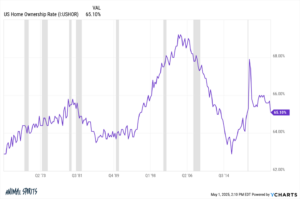

Part of the reason is most people already own a home:

Homeowners are content with the current situation as long as they’re not forced to sell and buy a new place. Housing prices are up a lot and most households were able to lock in much lower mortgage rates during the pandemic.

There is some sympathy for those who missed out but the majority of homeowners are pretty happy with the current situation. Sure, some people likely feel trapped in their current home because they have a 3% mortgage or can’t afford to trade up into a more expensive home with a 7% mortgage.

But that’s much better than being boxed out of a house altogether.

It feels like we’re going to be in a situation where the only people who can afford to buy are those who:

- Already have a ton of home equity in their current home.

- Get some financial support from their parents.

- Make a high income.

- Forsake lots of other financial goals to make it happen.

I would love to see a situation where politicians make housing their entire platform. Tear up all of the red tape. Incentive homebuilders to build more homes. Offer first-time homebuyers low mortgage rates they missed out on.

Young people don’t have a ton of political power so it’s not a demographic politicians are catering to. Maybe someday that will change, but not yet.