Blog

Mortgage Rates and Offer Prices

Unless you’ve been living under a rock, you’ve read an article or two (or ten?) about how crazy housing prices have gotten over the past couple of years. House prices have increased over 50% in some areas of the country during that time and for eager buyers it seems like there is no end in sight to the grind of trying to be competitive in this market. One of the main reasons prices have remained inflated is due to record low federal funds rates, and in turn mortgage rates during 2020 and 2021. 30-year mortgages were hovering in the high 2% range for much of that time and customers who were willing to switch to 15 year mortgages were rewarded with interest rates below 2%! With all of this information in mind, how should buyers view the price they are willing to pay for a house given that interest rates are likely to increase in the coming couple of years?

Understanding Amortization

When you finally close on a house, you will be presented with an amortization schedule that will show you what your monthly payment is expected to be over the next 30 years (or 15) and how much of each payment is going toward your principal pay-down vs. your interest. Naturally, if you lock in a lower interest rate for the life of the mortgage, your monthly payment will be lower as well. Given that we may be in a rising rate environment for the foreseeable future, I thought it would be helpful to look at an example of how increasing rates COULD influence the amount you might be willing to pay for a house.

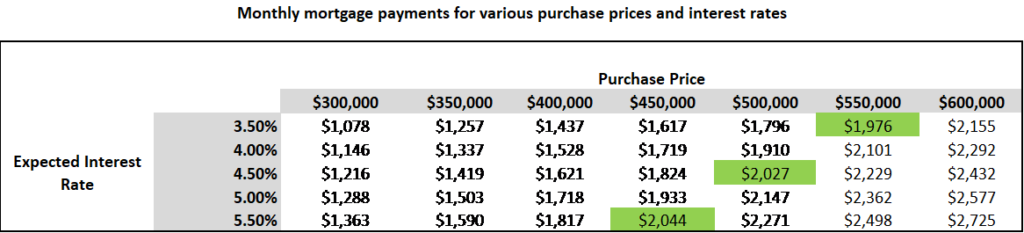

*For the purposes of this illustration we are only showing the principal and interest portion of a 30-year mortgage payment, assuming 20% down-payment, and not including property taxes or insurance.

In the above example, we have highlighted that if someone has a budget for an ability to spend approximately $2,000 per month on their mortgage payment then with interest rates at 3.5%, they will achieve that for a $550,000 house purchase. However, if rates were to increase to 4.5% their same $2,000 per month budget would now only afford them a $500,000 house (see green highlighted sections above). Taken that example further, at a 5.5% interest rate their $2,000 per month would now be buying a $450,000 house.

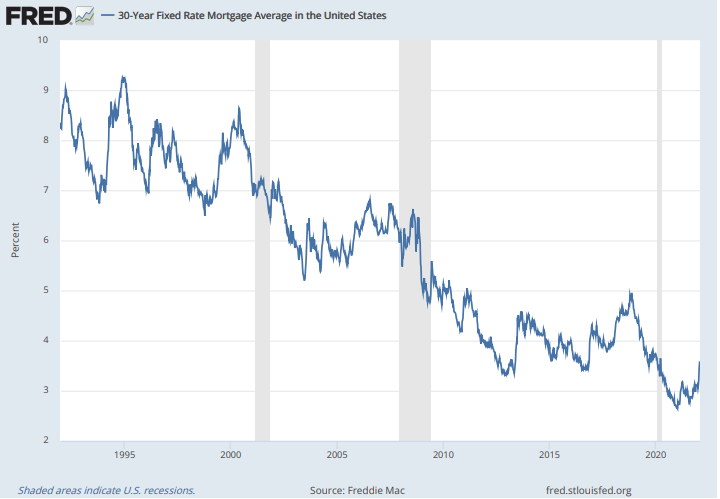

So, while I sympathize with people wanting to wait for the housing market to cool down, keep in mind that interest rates are likely to be increasing at the same time. In the example above, a 1% increase in rates meant a $50,000 purchase price difference in affordability. It quickly becomes apparent why these very low-rate environments we have enjoyed have spurred on the ability to afford MUCH more house along the way. Furthermore, while a 5% (or more) mortgage rate might sound crazy compared to where we’ve been recently, it is actually quite low when looking at typical 30-year fixed mortgage rates over the past 30 years (see graph below from the St. Louis Federal Reserve).

Value is Subjective

Finally, let me say this…the price of a good (including a house) is where supply and demand meet. What a home is worth, is simply a function of how much inventory is on the market and how many buyers are competing for that inventory. Additionally, some buyers might view certain aspects of a house in higher regard compared to the very next buyers that walk through. So, while it is important to consider interest rates and how they will impact your monthly payment, and ultimately your offer price, it’s also important to decide what you are willing to pay for a house and stick to your guns. It could just mean that being equipped with your desired monthly payment amount is more valuable in a changing rate environment than sticking to a specific purchase price.