It’s safe to say that with all the talk of a pending recession coming into 2023, the first half of the year has been more favorable than expected for stockholders. The S&P 500 is up around 20% from its lows in October 2022. This has been nice to see but is largely driven by 6 or 7 large mega cap companies and not the large portion of the 500 stocks that make up the index. So, while the first half has been a nice reprieve from 2022, I think it’s important to ask the question “what will the second half of the year hold for stocks?” In my opinion, I don’t think we should get too quick to assume the second half will be just as rosy. Let’s explore:

We Still Aren’t Back to All-Time Highs

As much as I want to celebrate the recent rise in stocks, the S&P 500 is still in a drawdown. The index closed at a record of 4,796.56 on January 3, 2022 and hasn’t seen that level anytime since. Even if we include re-invested dividends, the S&P 500 is about 6% off its highs:

We’ve talked in the past about the frequency of false rallies during bear markets and we may be experiencing such a fakeout today. I don’t say this because I’m pessimistic about the future, but because drawdowns can last longer than we might imagine.

Inflation is Still Higher than Normal

Though the annual inflation rate hit a recent low of 4% over the past year, we are still in an environment where individuals are dealing with the effects of rising costs. We see this both among consumers and investors.

-

-

- According to the Federal Reserve 2022 report on the Economic Well-Being of U.S. Households, “more adults experienced spending increases than income increases” over the past year, with 23% of adults reporting that their spending had increased but their income had not.

- For investors, the impact of inflation has been equally troublesome. Though U.S. stocks are only 6% below their all-time highs on a total return basis, once we adjust for inflation, the actual drawdown is closer to 15% (according to Robert Shiller’s data). This means that even if U.S. stocks hit new all-time highs, we would still have a way to go before our purchasing power fully recovered.

- Overall, while inflation does seem to be slowing down, the damage it has caused is already done. We can’t escape the fact that we need 18% more money today to buy the same set of goods that we could’ve bought in January 2020. Though the data is moving in the right direction, we should still be weary of inflation’s long-term impact.

-

This Bull Market is VERY Concentrated

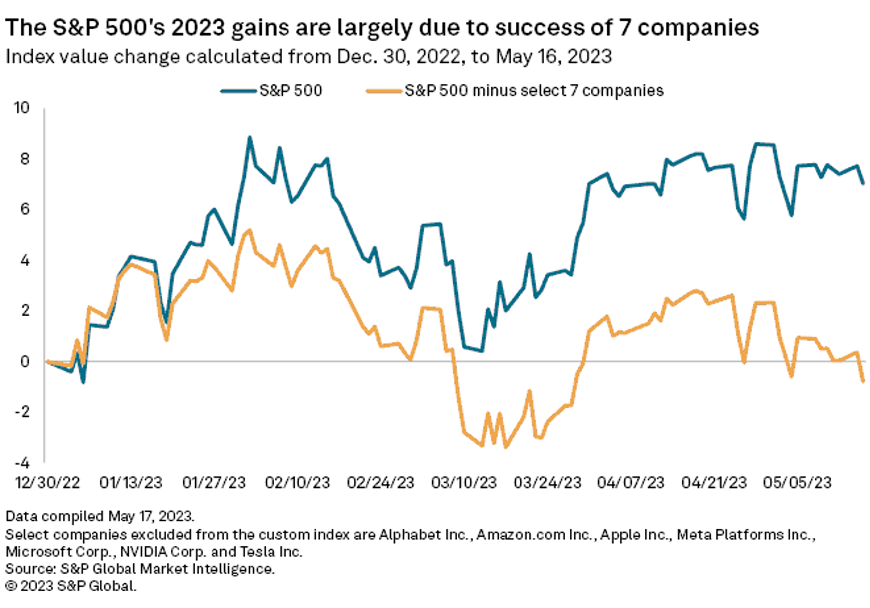

Even though a new bull market is upon us, it’s being driven by an exceptionally small number of stocks. As S&P Global recently noted, so far in 2023 the entire gain in the S&P 500 can be explained by just 7 companies:

If we removed these 7 companies from the index (orange line pictured above), the S&P 500 would be flat on the year. There’s plenty of research demonstrating that a small number of companies drive the vast majority of the market’s overall return.

When you combine the current drawdown, the possibility of further inflation, and the high amount of market concentration in our current rally, you can see why I’m hesitant to take a victory lap for the new bull market. Though I’m always bullish in the long-term, I’m not necessarily bullish in the short-term. I remain optimistic but cautious as we head into the second half of 2023.