“Benefits of Buying Into the Market Over Time”

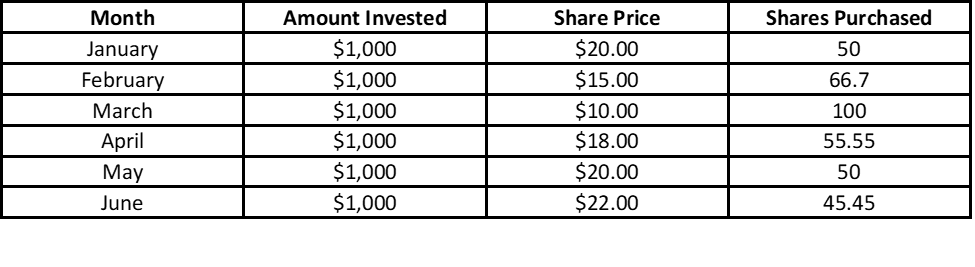

I’ve received several questions over the past month about where the “bottom” of the stock market is and when is the right time to buy back in? While I appreciate that these people have sought out my advice, the reality is that nobody really knows the answers to these questions. If we’ve learned one thing over the past month it’s that the stock market is fickle and just when someone thinks they have it figured out, it does the opposite. Since the stock market always can go up or down without much notice, the idea of dollar cost averaging is an attractive one if you find yourself sitting on the sidelines waiting to invest again. We will take some time to break down exactly what dollar cost averaging is and why it could be a beneficial strategy over the coming months. What is Dollar Cost Averaging In simplest terms, dollar cost averaging is simply investing the same amount of money at regular intervals (usually monthly or quarterly). Since stock markets rise and fall, the idea is that you continue to invest the same dollar amount at each interval, but the number of shares it actually buys you will change based on fluctuating stock prices. When prices are higher, you would buy fewer shares; when prices are lower, you would buy more shares. Many times, people are performing dollar cost averaging with their 401K investments because the same $ amount will come out of each paycheck to buy into various funds. This can be a disciplined approach to take especially when the market is going through volatile periods. Provides Lower Cost It’s a simple approach, but the reality is that dollar cost averaging can provide an investor with a lower cost per share over time. Here is an example below: The Average Price Per Share: $105 (total of monthly share prices) / 6 (months) = $17.50 per share

The Average Cost Per Share: $6,000 (total cost) / 367.7 (total shares purchased) = $16.31 per share

From this example you can see that dollar cost averaging provided this individual with a cheaper cost per share than simple the average share price. Of course, trading fees and other fund expenses should be weighed and considered when taking this type of an approach.

Provides Lower Risk

Perhaps the most important reason that Dollar Cost Averaging makes sense right now is that you avoid investing a large lump sum of money when prices are fluctuating and may still be inflated. The averaging tactic eliminates the need to try and time the market and momentum swings as well as the folly of committing to a one-time purchase which may be on the cusp of further downturns. Of course, if the market only trends upwards during a dollar cost averaging approach then an investor has the risk of paying a higher average price compared to if they invested their lump sum at the beginning. However, the benefits of this approach are more pronounced in volatile markets because it can also provide a peace of mind that investors don’t have to worry about “buyer’s remorse” after dramatic market movements.

Dollar Cost Averaging has it’s advantages and disadvantages. One of the biggest benefits might be more psychological than strategic, but the upside can also be seen from a mathematical perspective as well. Individuals should not see dollar cost averaging as the only solution, but should combine this with diversification, allocation, and re-balancing tools that help with the overall health of a portfolio.

The Average Price Per Share: $105 (total of monthly share prices) / 6 (months) = $17.50 per share

The Average Cost Per Share: $6,000 (total cost) / 367.7 (total shares purchased) = $16.31 per share

From this example you can see that dollar cost averaging provided this individual with a cheaper cost per share than simple the average share price. Of course, trading fees and other fund expenses should be weighed and considered when taking this type of an approach.

Provides Lower Risk

Perhaps the most important reason that Dollar Cost Averaging makes sense right now is that you avoid investing a large lump sum of money when prices are fluctuating and may still be inflated. The averaging tactic eliminates the need to try and time the market and momentum swings as well as the folly of committing to a one-time purchase which may be on the cusp of further downturns. Of course, if the market only trends upwards during a dollar cost averaging approach then an investor has the risk of paying a higher average price compared to if they invested their lump sum at the beginning. However, the benefits of this approach are more pronounced in volatile markets because it can also provide a peace of mind that investors don’t have to worry about “buyer’s remorse” after dramatic market movements.

Dollar Cost Averaging has it’s advantages and disadvantages. One of the biggest benefits might be more psychological than strategic, but the upside can also be seen from a mathematical perspective as well. Individuals should not see dollar cost averaging as the only solution, but should combine this with diversification, allocation, and re-balancing tools that help with the overall health of a portfolio.

March 20th, 2020

Copyright © 2024

Van Gelder Financial